Variance Analysis

Variance analysis is the procedure of computing the differences between standard costs and actual costs and recognizing the causes of those differences. Studies indicated that variance is the difference between standard performance and actual performance. It is the process of scrutinizing variance by subdividing the total variance in such a way that management can assign responsibility for off-Standard Performance.

Variance analysis has four steps:

- Compute the amount of the variance.

- Determine the cause of any significant variance.

- Identify performance measures that will track those activities, analyse the results of the tracking, and determine what is needed to correct the problem.

- Take corrective action.

Variance Analysis : A Four-Step Approach to Controlling Costs

The variance can be favourable variance or unfavourable variance. When the actual performance is superior to the Standard, it resents "Favourable Variance." Likewise, where actual performance is under the standard it is called as "Unfavourable Variance."

Variance analysis assists to fix the responsibility so that management can determine-

- The amount of the variance

- The reasons for the difference between the actual performance and budgeted performance.

- The person responsible for poor performance

- Corrective actions to be taken.

Types of Variances :

Variances is categorised into two categories that include Cost Variance and Sales Variance.

Components of Variance Analysis :

Cost Variance :

Total Cost Variance is the difference between Standards Cost for the Actual Output and the Actual Total Cost sustained for manufacturing actual output. The Total Cost Variance consists of:

A. Direct Material Cost Variance

B. Direct Labour Cost Variance

C. Overhead Cost Variance

A. Direct Material Variances:

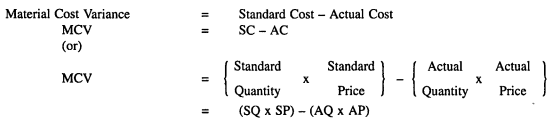

Direct Material Variances are also known as Material Cost Variances. The Material Cost Variance is the difference between the Standard cost of materials for the Actual Output and the Actual Cost of materials used for producing actual output. The Material Cost Variance is computed as:

(1) Material Price Variance (MPV) : MPV is the difference between the standard cost of actual quantity and actual cost for actual quantity.

MPV = (SP - AP) x AQ

(2) Material Usage Variance (MUV) : MUV is the difference between the standard cost of standard quantity of material for actual output and the Standard cost of the actual material used.

MUV = SP x (SQ - AQ)

(3) Material Mix Variance (MMV) : It is the portion of the material usage variance which is due to the difference between the Standard and the actual composition of mix. Material Mix Variance is calculated under two situations as follows :

(a) When Actual Weight and Standard Weight of Mix are equal :

(i) The formula is used to calculate the Variance:

MMV = SP x (SQ - AQ)

(ii) In case standard quantity is revised due to shortage of a particular categoryof materials, the formula will be changed as follows :

MMV = SP x (RSQ - AQ)

Where, RSQ = Revised standard quantity

(b) When Actual Weight and Standard Weight of Mix are different:

(i) The formula used to calculate the Variance is :

MMV = ( Total weight of actual mix/ Total weight of standard mix X standard cost of standard mix) - standard cost of actual mix

(ii) In case the standard is revised due to the shortage of a particular category of materials, the alternative formula will be as follows:

MMV = ( Total weight of actual mix/ Total weight of standard mix X standard cost of revised standard mix) - standard cost of actual mix

(3) Materials Yield Variance (MYV) : It is the portion of Material Usage Variance. This variance arises due to spoilage, low quality of materials and defective production planning etc. Materials Yield Variance may be defined as "the difference between the Standard Yield Specified and the Actual Yield Obtained." This variance may be calculated as under:

MYV = SR x ( AY - SY)

Where, AY= Actual Yield,

SY = Standard Yield and

Standard Rate is calculated as follows :

Standard Rate = Standard cost of standard mix / Net standard output.

Verification:

1. MCV = MPV + MUV

2. MUV = MMV + MYV

Notes- positive means favourable(F) and negative means adverse(A)

B. Labour Cost Variance:

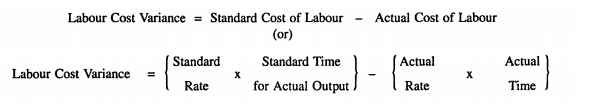

Labour Cost Variance is the difference between the Standard Cost of labour allowed for the actual output achieved and the actual wages paid. It is also termed as Direct Wage Variance or Wage Variance. Labour Cost Variance is calculated as follow:

1. Labour Cost Variance (LCV): Labour Cost Variance is the difference between the Standard Cost of labour allowed for the actual output achieved and the actual wages paid.

Labour Cost Variance = Standard Cost of Labour - Actual Cost of Labour (or) Labour Cost Variance = {SR x SH for AO} - { AR x AH}

Where,

SR = Standard Rate,

ST = Standard Hour,

AO = Actual Output,

AR = Actual Rate,

AT = Actual Hour.

2. Labour Rate Variance (LRV) : It is that part of labour cost variance which is due to the difference between the standard rate specified and the actual rate paid. This variances arise from the following reasons:

(a) Change in wage rate.

(b) Faulty recruitment.

(c) Payment of overtime.

(d) Employment of casual workers etc.

It is expressed as follows :

LRV = AH ( SR - AR)

3. Labour Efficiency Variance (LEV) : Labour Efficiency Variance otherwise knownasLabour Time Variance. It is that portion of the Labour Cost Variance which arises duetothe difference between standard labour hours specified and the actual labour hours spent. The usual reasons for this variance are

(a) poor supervision

(b) poor working condition

(c) increase in labour turnover

(d) defective materials.

It may be calculated as following:

LEV = SR ( SH - effective AH)

4. Labour Idle Time Variance : Labour Idle Time Variance arises due to abnormal situations like strikes, lockout, breakdown of machinery etc. In other words, idle time occurs due to the difference between the time for which workers are paid and that which they actually expend upon production.

It is calculated as follows :

Idle Time Variance = Idle Hours x Standard Rate

5. Labour Mix Variance (LMV) : It is otherwise known as Gang Composition Variance. This variance arises due to the differences between the actual gang composition than the standard gang composition. Labour Mix Variance is calculated in the same way of Materials Mix Variance. This variance is calculated in two ways:

(i) When Standard and actual times of the labour mix are same: The formula for its computation may be as follows :

LMV = Standard cost of standard labour mix - Standard cost of Actual labour mix.

(ii) When Standard and actual times of the labour mix are different : Changes in the composition of a gang may arise due to shortage of a particular grade of labour. It may be calculated as follows :

LMV = (RSH - AH) x SR Where, Revised Standard Hour (RSH) = Total Actual Hour/ Total standard hour X actual hour.

6. Labour Yield Variance (LYV) : 'This variance is calculated in the same way as Material Yield Variance. Labour Yield Variance arises due to the variation in labour cost on account of increase or decrease in yield or output as compared to relative standard. The formula for this purpose is as follows:

LYV = Standard labour cost per unit of output X (Standard output for actual hour - actual output)

Verification:

1. Labour Cost Variance = Labour Rate Variance + Labour Efficiency Variance

2. Labour Efficiency Variance = Labour Mix Variance + Labour Yield Variance

C. Overhead variance :

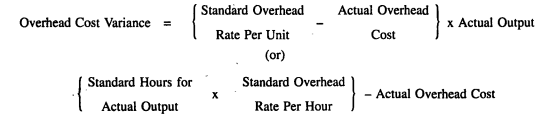

Overhead is explained as the cumulative of indirect material cost, indirect labour cost and indirect expenses. Overhead Variances may occur due to the difference between standard cost of overhead for actual production and the actual overhead cost incurred. The Overhead Cost Variance may be computed as follows:

Classification of Overhead Variance Overhead Variances can be classified as :

A. Variable Overhead Variances:

(1) Variable Overhead Cost Variance

(2) Variable Overhead Expenditure Variance

(3) Variable Overhead Efficiency Variance

B. Fixed Overhead Variance:

(a) Fixed Overhead Cost Variance

(b) Fixed Overhead Expenditure Variance

(c) Fixed Overhead Volume Variance

(d) Fixed Overhead Capacity Variance

(e) Fixed Overhead Efficiency Variance

(f) Fixed Overhead Calendar Variance

Sales variance :

Sales Variances can be calculated by two methods:

A. Sales Value Method.

B. Sales Margin or Profit Method.

Basis of Calculation: Variance analysis emphasizes the causes of the variation in income and expenses during a period compared to the financial plan. In order to make variances significant, the idea of 'flexed budget' is used when calculating variances. Flexed budget acts as a link between the original budget (fixed budget) and the actual results. Flexed budget is prepared in retrospect based on the actual output. Sales volume variance accounts for the difference between budgeted profit and the profit under a flexed budget. All remaining variances are calculated as the difference between actual results and the flexed budget.

To summarize, Variance Analysis, is administrative accounting which denotes to the analysis of deviations in financial performance from the standards definite in organizational budgets. In Variance Analysis, the difference between actual cost and its budgeted or standard cost segregated into price or quality component. It has been shown that favourable variance occurs when output exceeds input or when the price paid for the goods and services is less than anticipated. An unfavourable variance occurs when output is less than input or when the price for goods and services is greater than expected.

No comments:

Post a Comment